Find purpose

Embrace community

Experience God’s Love

Classic Worship: 10 am every Sunday

A timeless service rooted in Lutheran tradition, featuring liturgy, hymns, and an inspired message from God’s word

Modern Worship: 11:30 am every Sunday

A relaxed, worship-driven service with contemporary songs

Prince of Peace Lutheran Church, inspired by God’s great commission, will be a neighbor among all neighbors

Guided by the teachings of Christ, our mission is to foster a diverse and inclusive community where all individuals, regardless of background, are warmly welcomed and empowered on their spiritual journey.

Come - worship, grow your faith, and feel God’s love

What’s happening at POP

Children

●

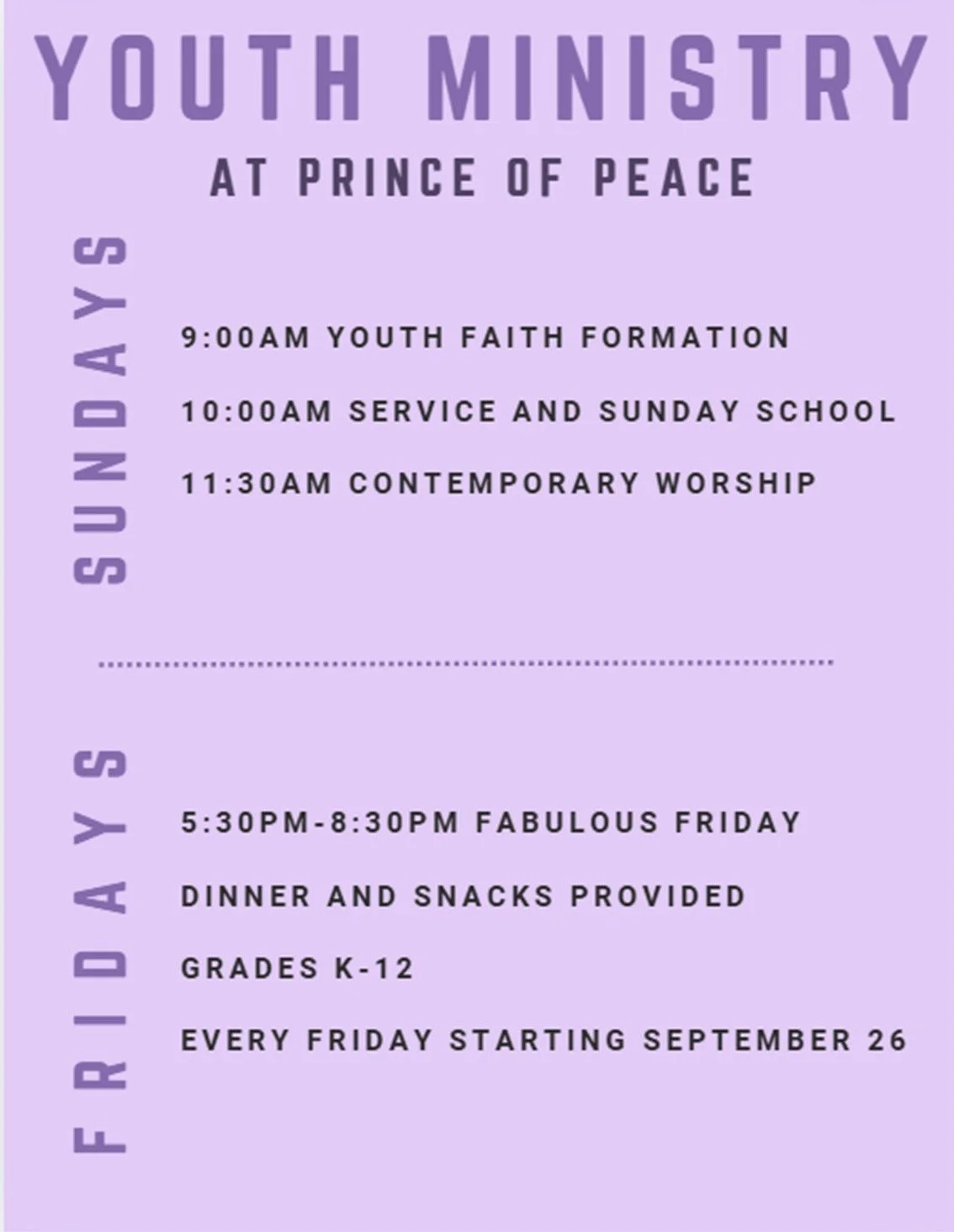

Youth

●

Family

●

Community

●

Children ● Youth ● Family ● Community ●

Ministry Programs

Whether you're seeking spiritual growth or opportunities to serve others, we invite you to explore our ministries - there are programs for every stage of your faith journey. You’ll find a place where you can grow, connect, and share in God’s love.

Highlights from our Platinum Jubilee 70th Anniversary Sunday

Come as you are

All are welcome to join and worship

19030 8th Ave S, Seatac, WA 98148